U.S. stocks surged to close higher on Wednesday as the presidential election race remained cloudy but the likelihood of gridlock in Congress made investors optimistic that major policy changes would be difficult to enact.

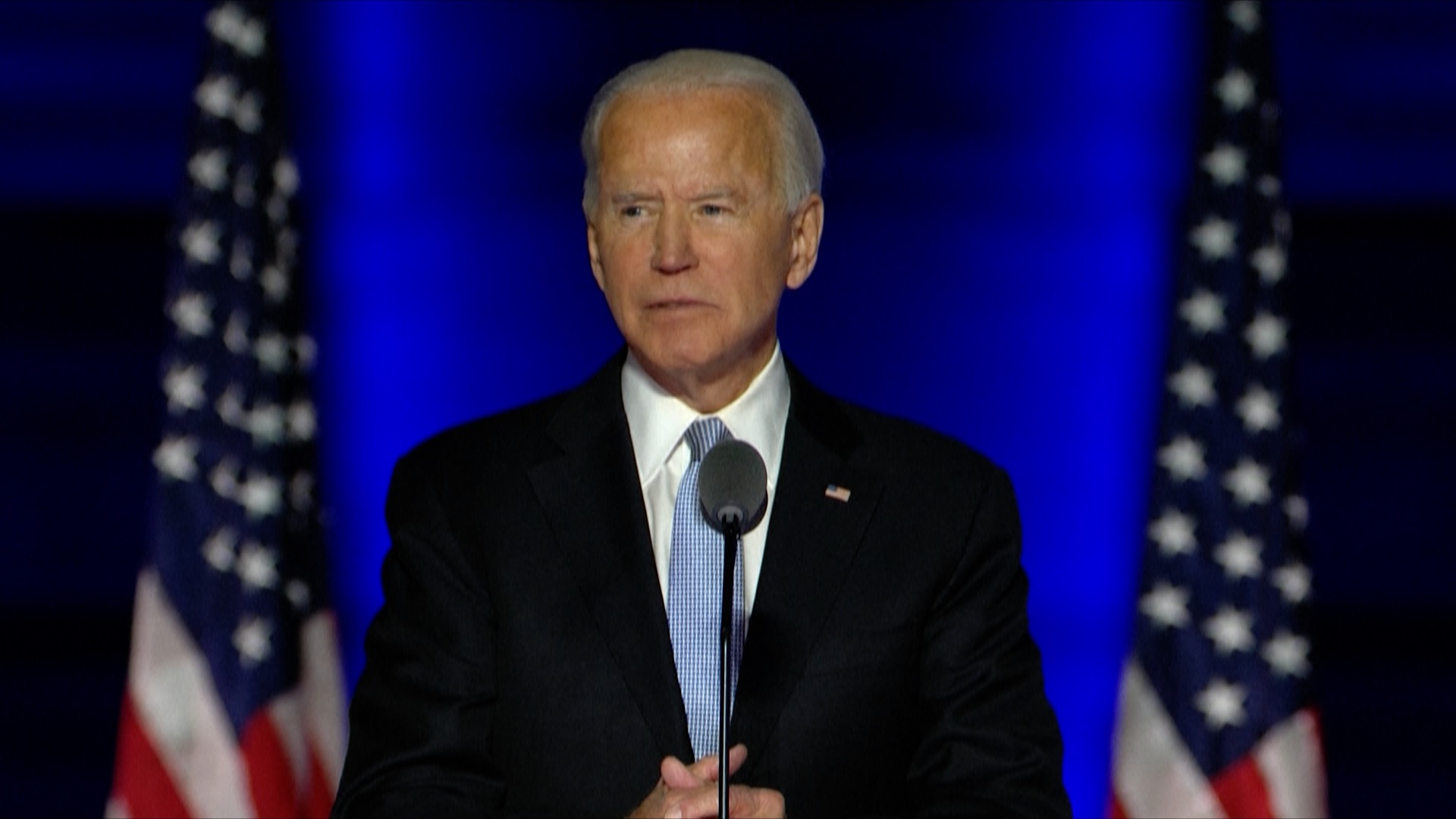

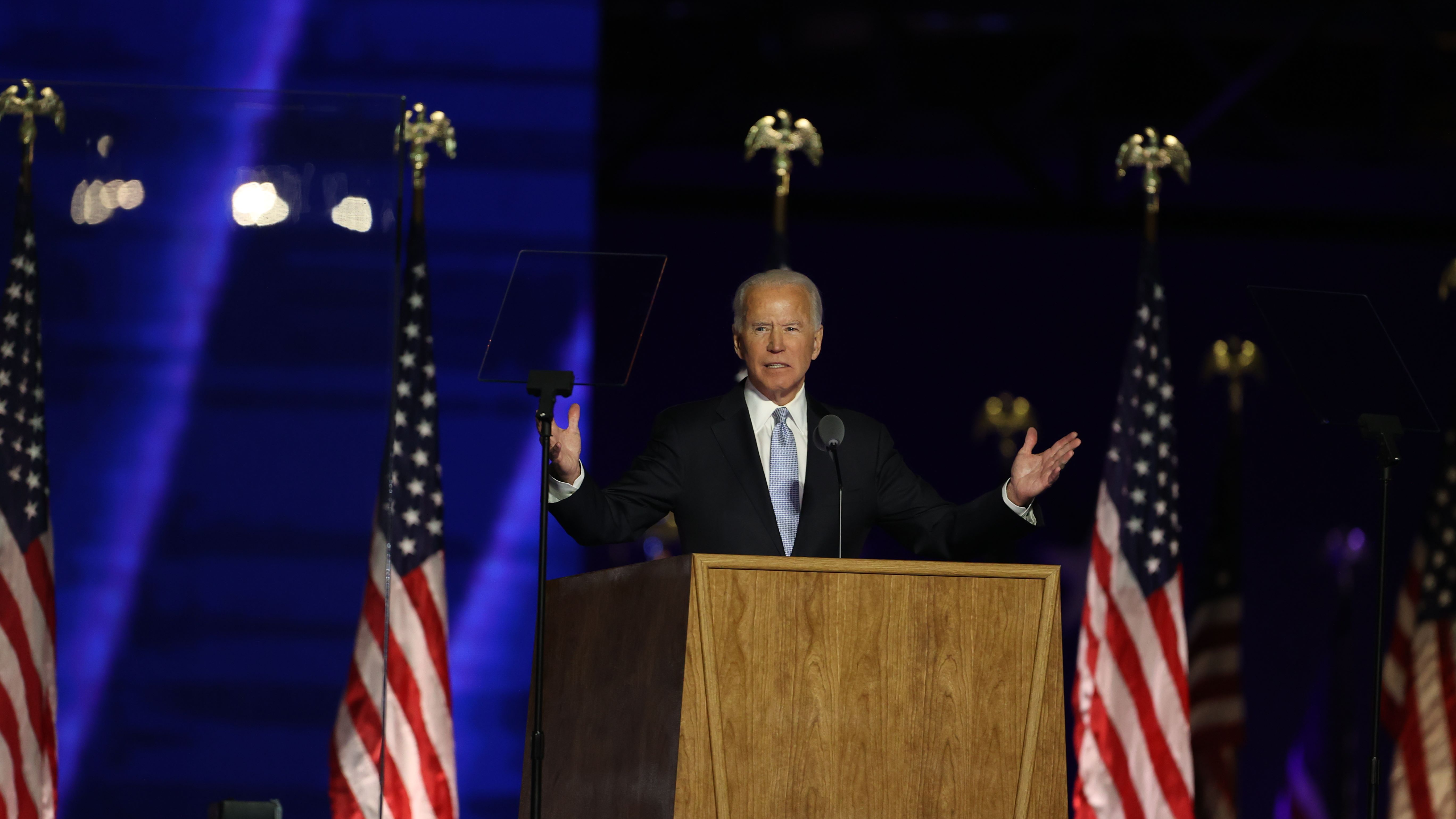

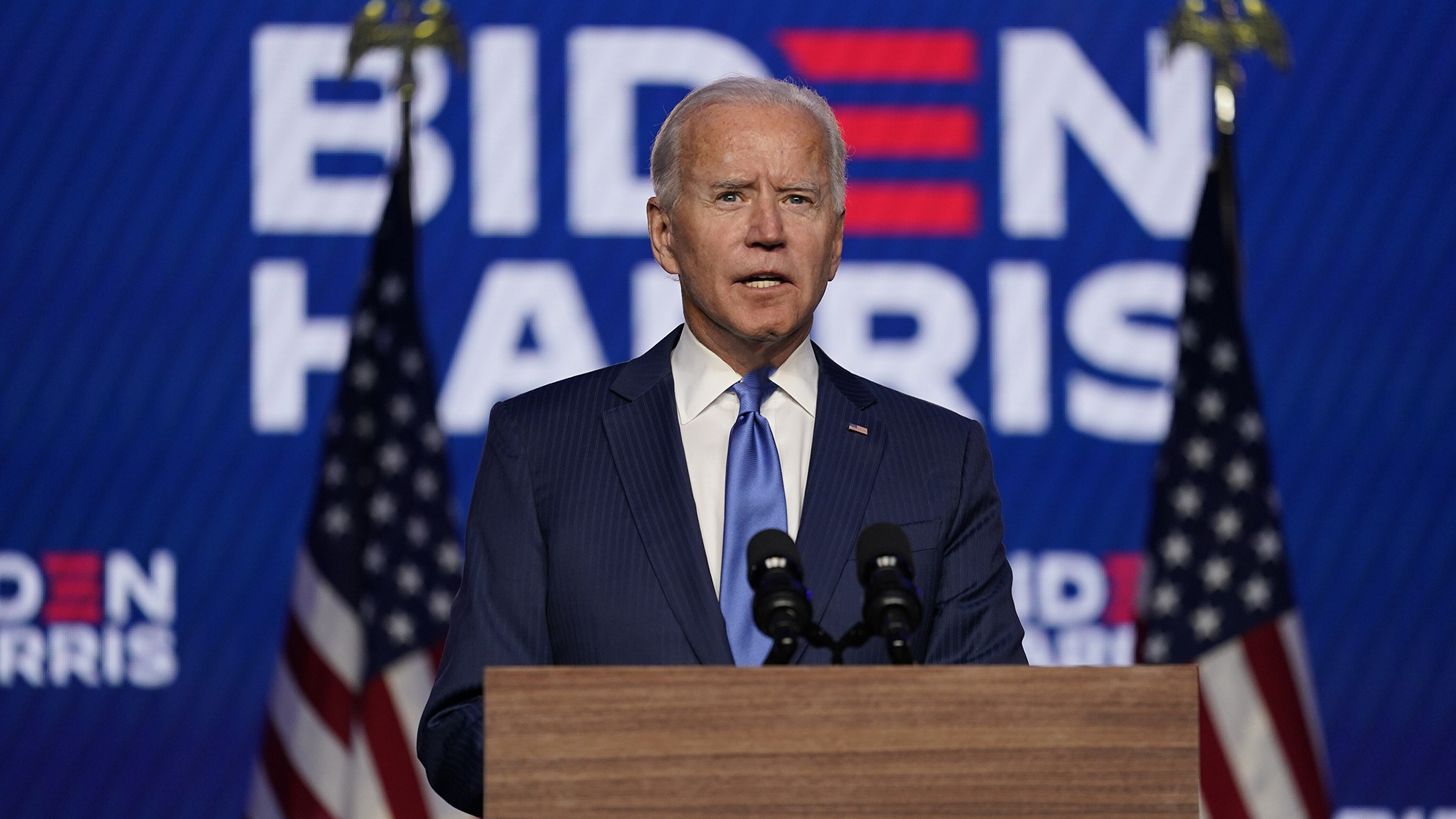

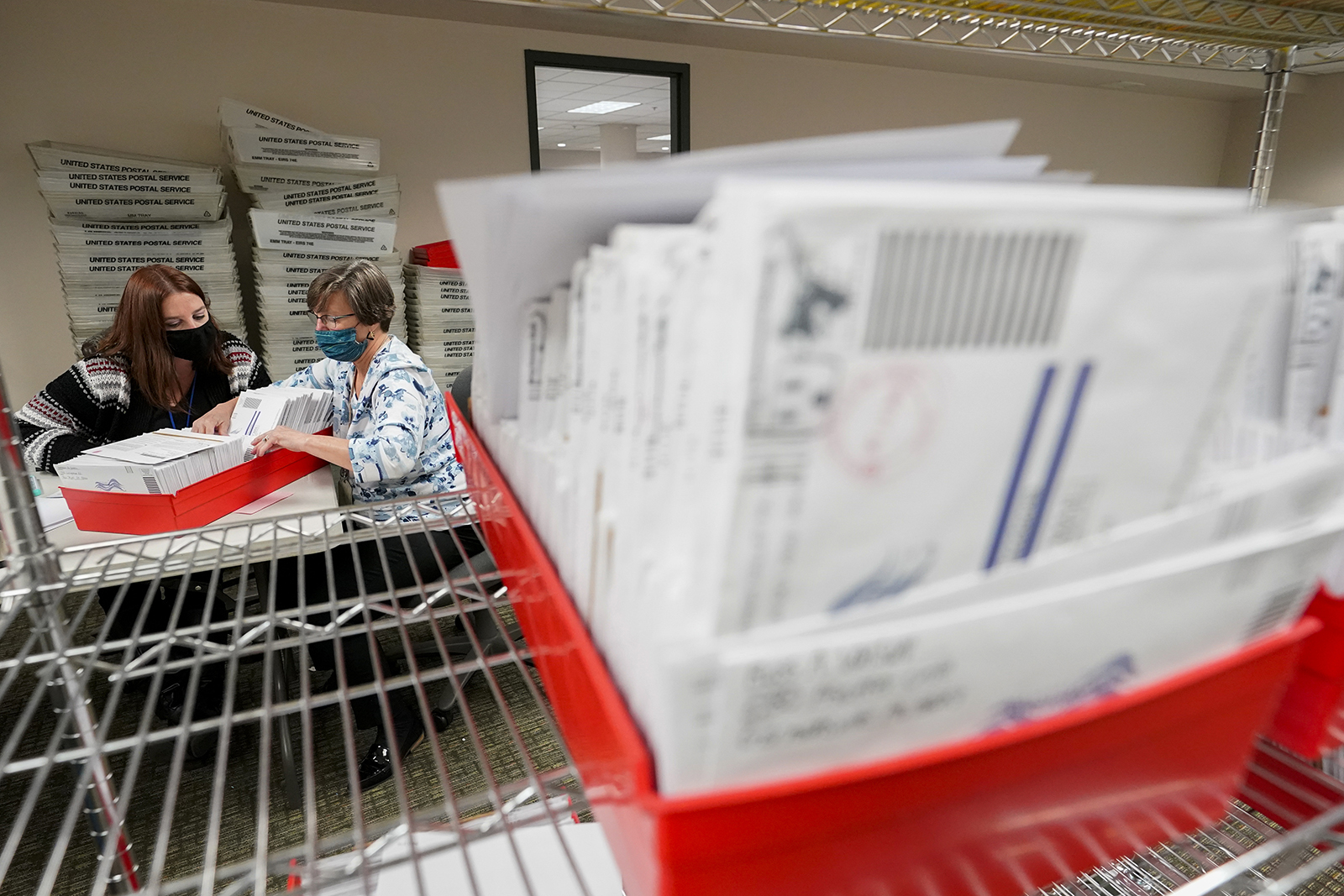

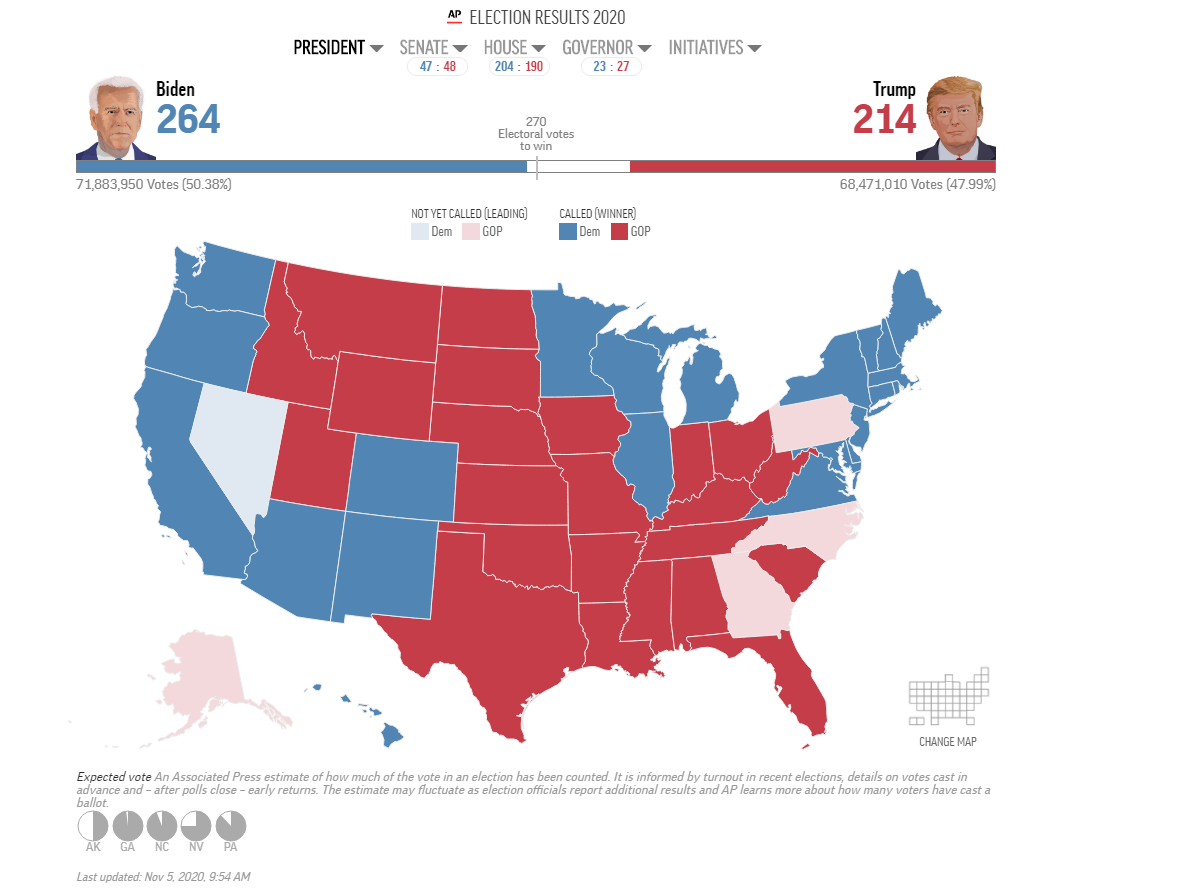

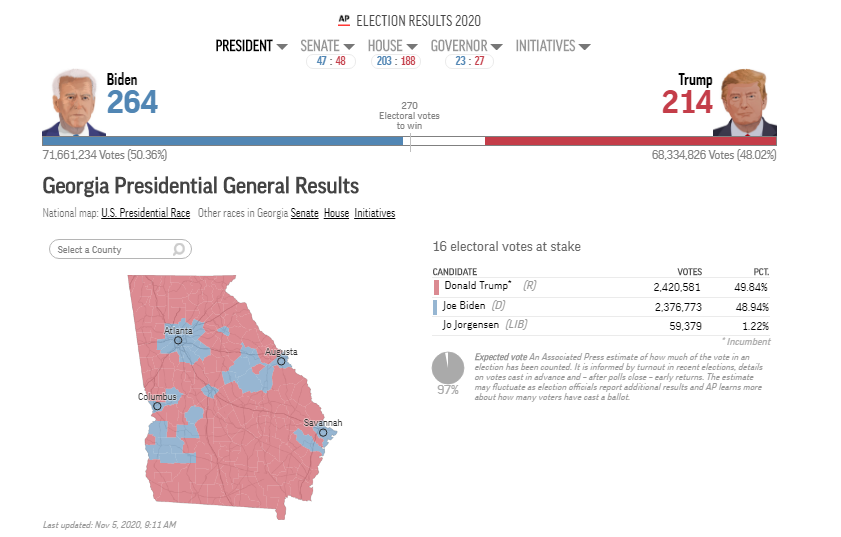

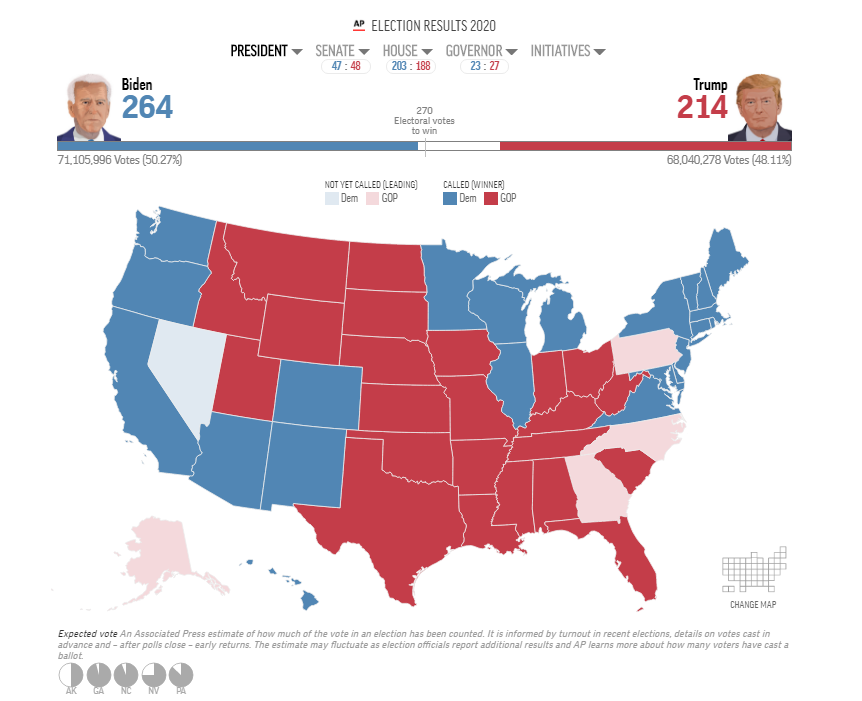

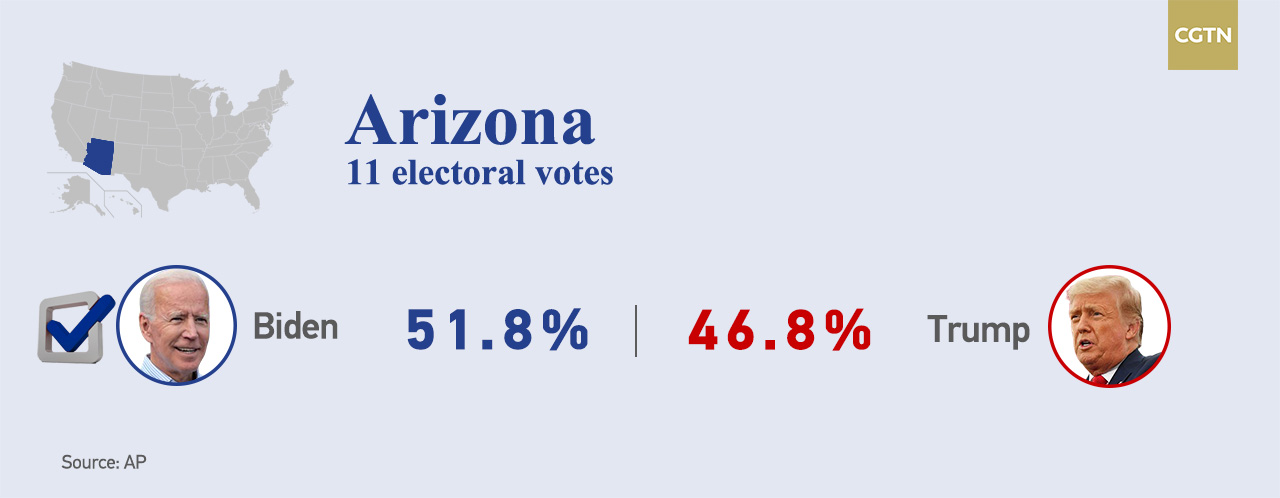

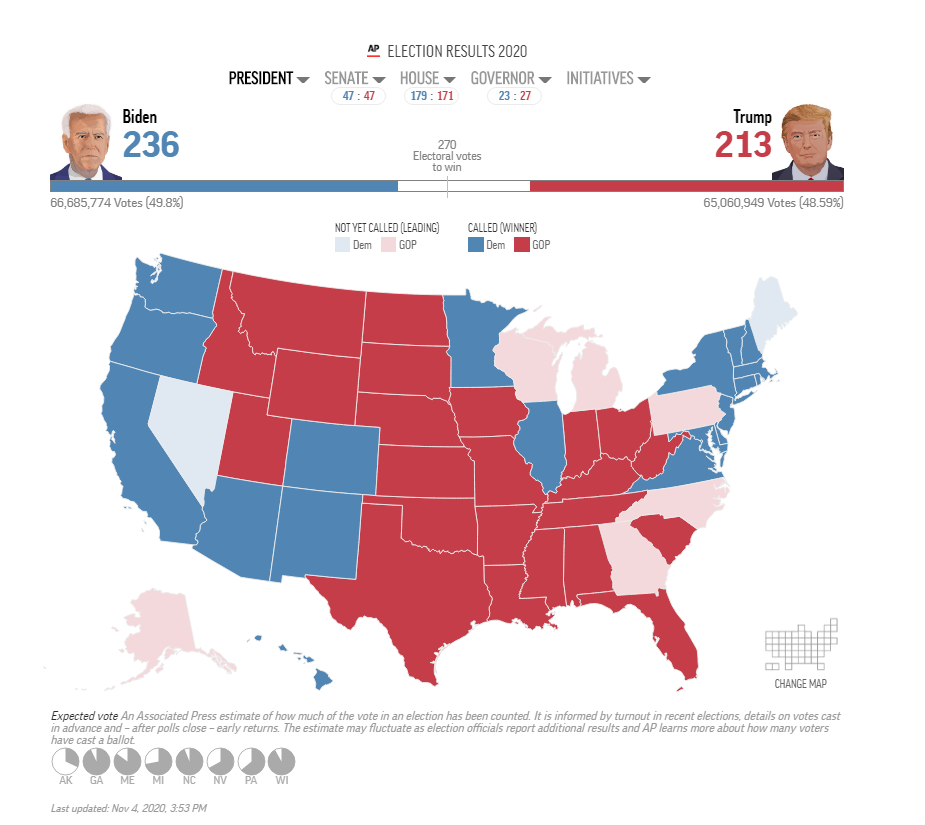

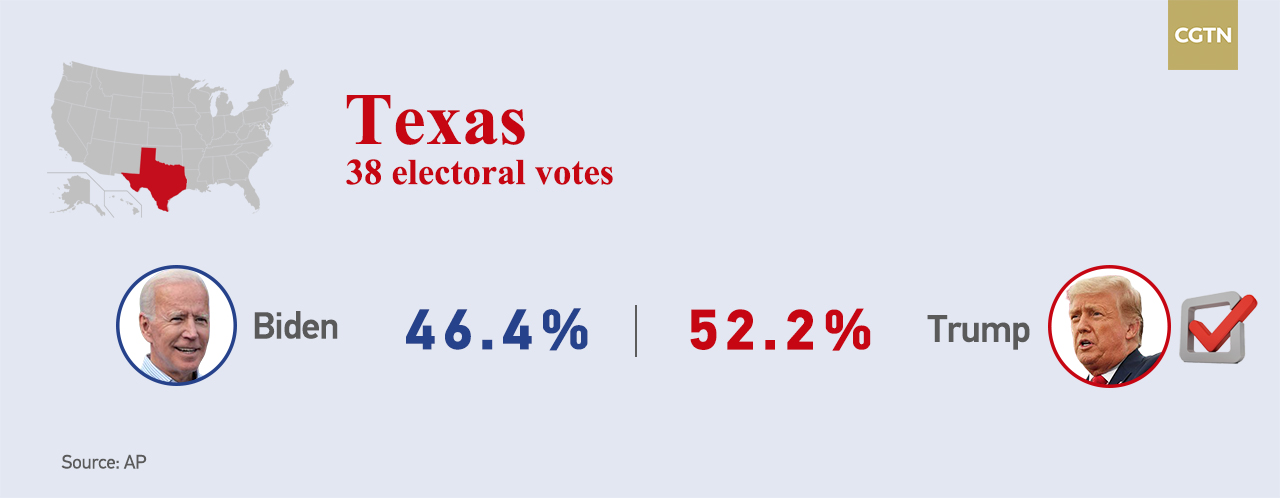

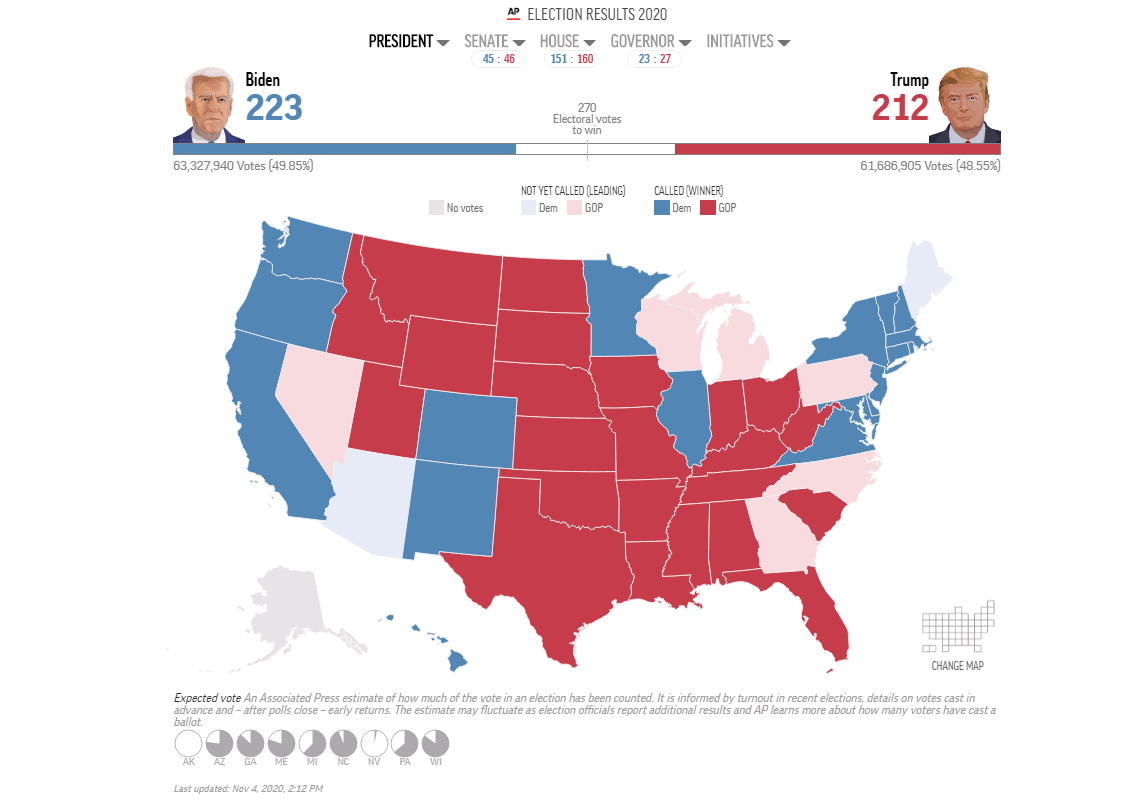

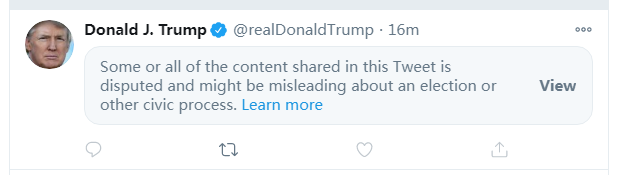

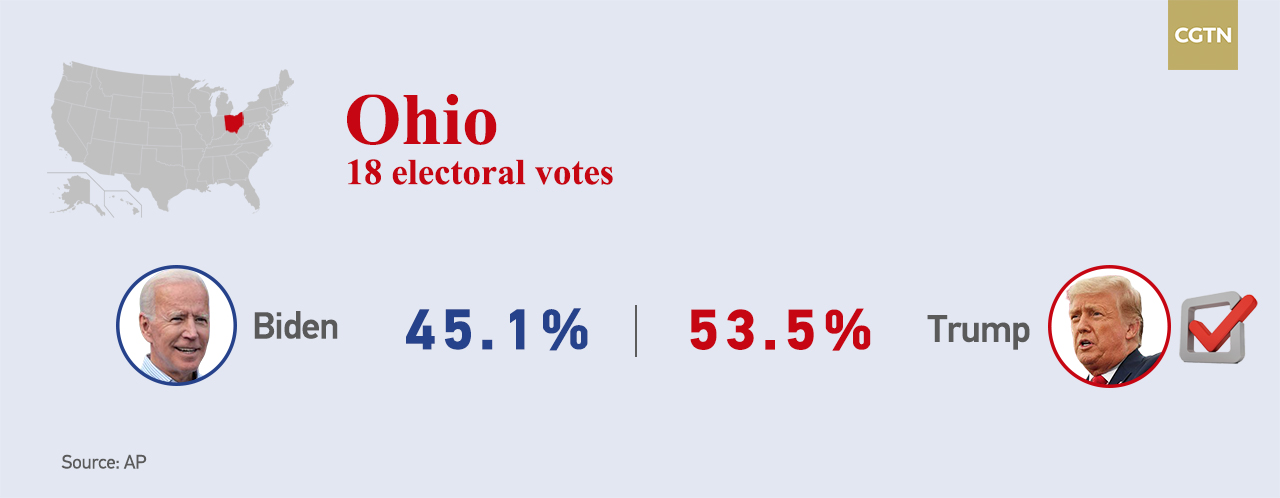

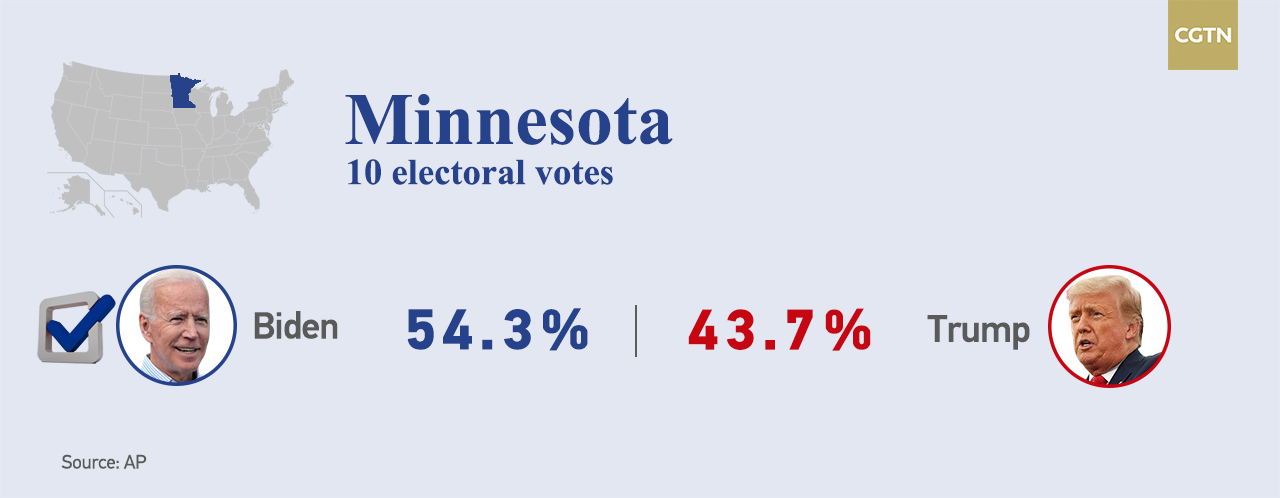

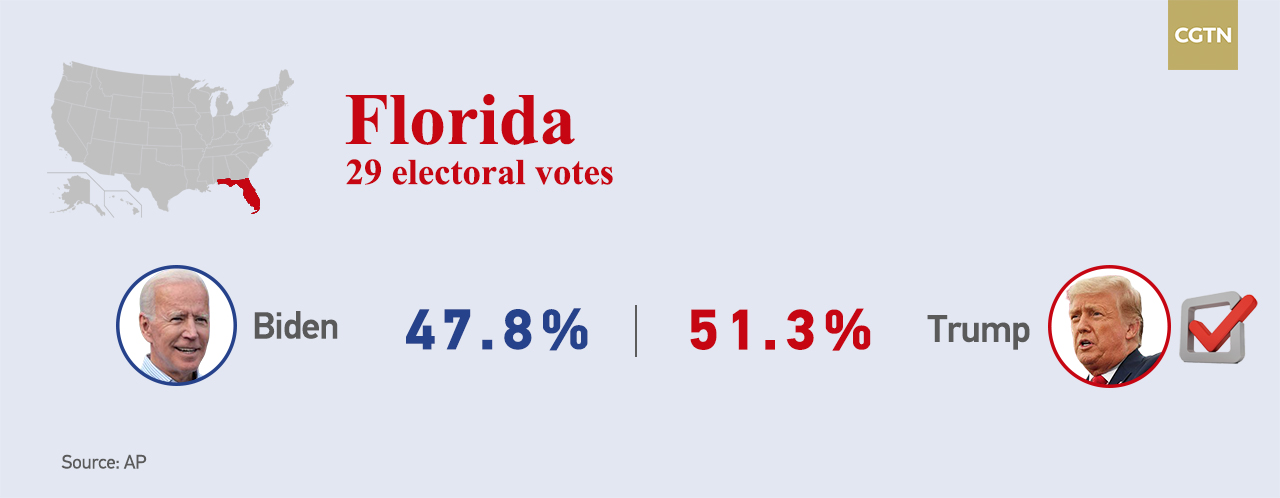

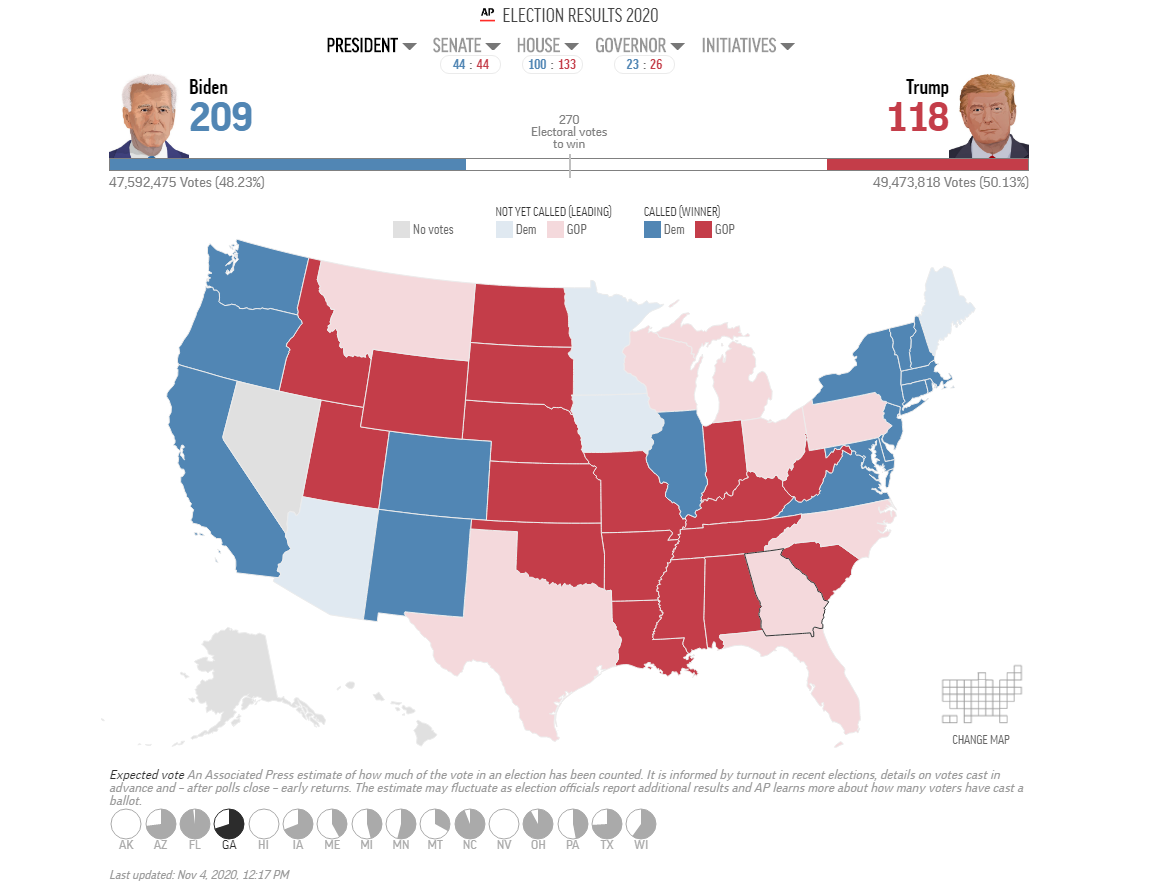

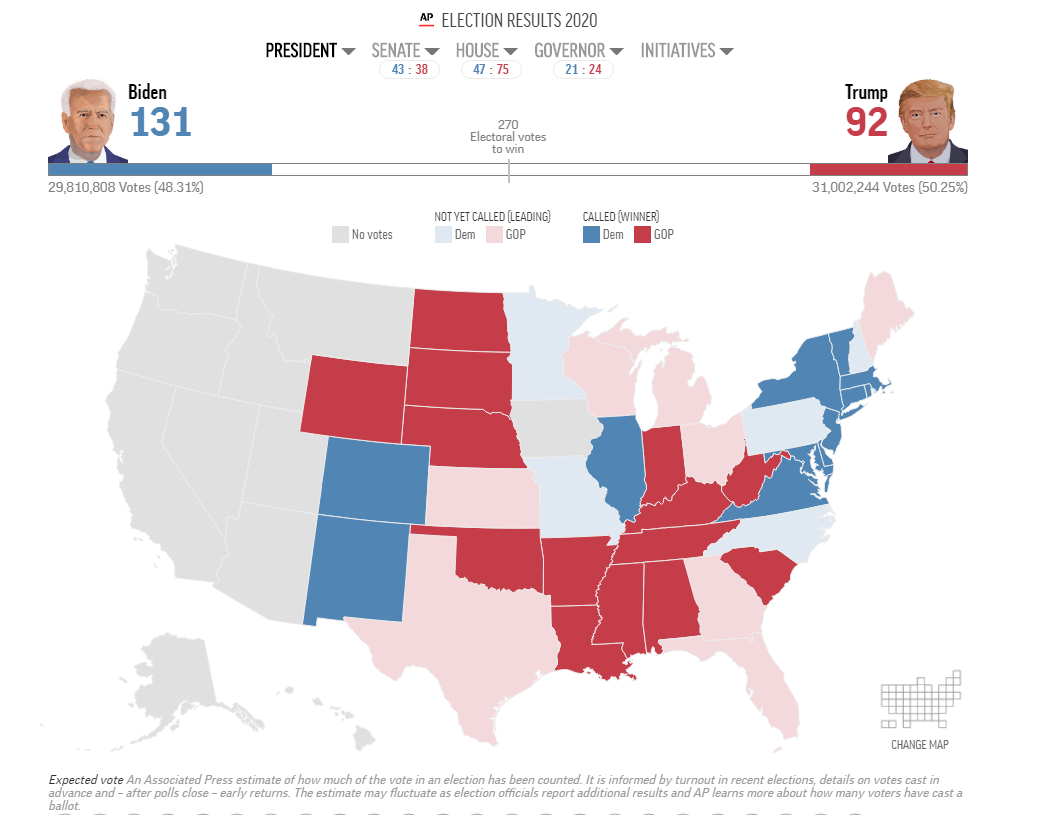

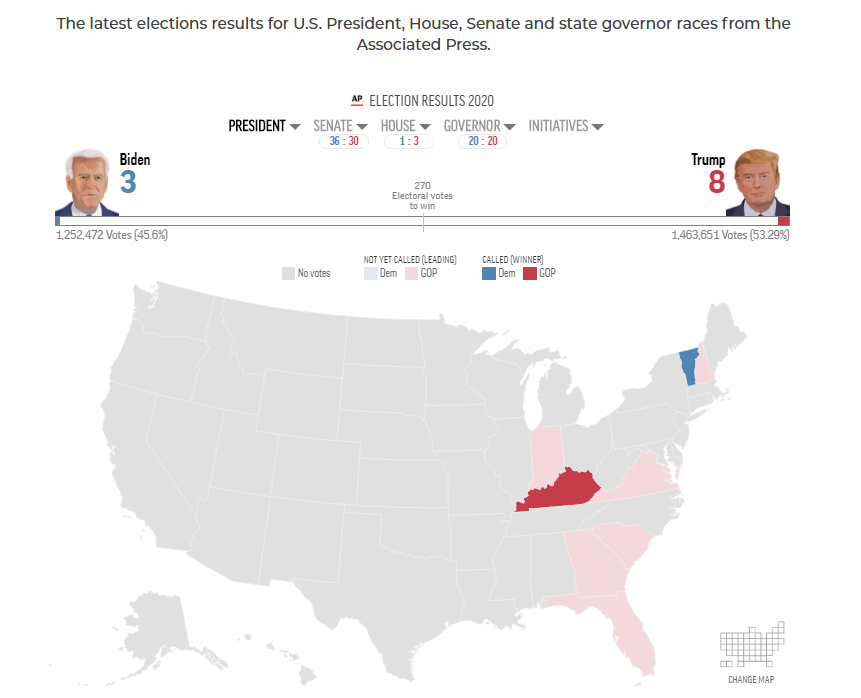

Both President Donald Trump and Democratic nominee Joe Biden still had paths to reach the 270 Electoral College votes needed to win as states kept counting mail-in ballots.

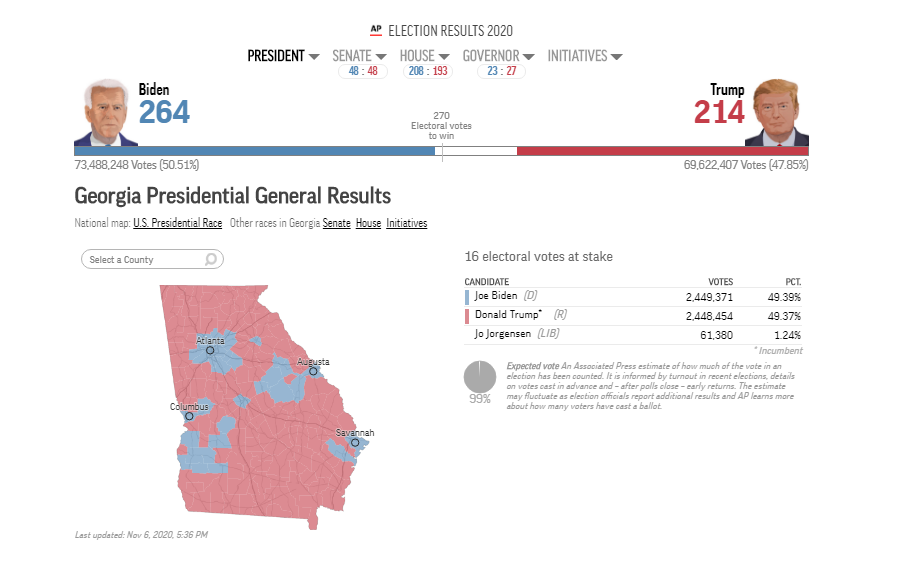

As of the time of writing, Joe Biden is now leading the race, with 264 electoral votes, according to AP. President Trump has 214 electoral votes.

U.S. election updates live: Trump, Biden predict win with a few key states votes still being counted

Votes are still being counted in five states – Alaska, Georgia, North Carolina, Nevada and Pennsylvania.

Growth stocks, currently comprised of a large portion of names in areas such as tech, surged by 4.31 percent as investors expected them to keep outperforming value stocks as they have in recent months. Value names, which closed flat, are currently comprised of mostly cyclical stocks such as banks and energy.

"Even if Joe Biden wins the presidency, it looks like we are going to have a divided Congress so the opportunity to have meaningful change at the fiscal level is pretty slim, and that is what is being priced into the back end of the market today," said David Joy, chief market strategist at Ameriprise Financial in Boston.

"If we are going to have a similar type of economic environment as we've had, then we are going back to an emphasis on trying to find earnings in a relatively scarce earnings environment, back to the same winners as before."

The Dow Jones Industrial Average rose 367.63 points, or 1.34 percent, to 27,847.66, the S&P 500 percent gained 74.28 points, or 2.20 percent, to 3,443.44 and the Nasdaq Composite percent added 430.21 points, or 3.85 percent, to 11,590.78.

It was the biggest daily percentage gain for the S&P 500 since June 5 and for the Nasdaq, since April 14. Still, advancing issues outnumbered declining ones on the NYSE by just a 1.36-to-1 ratio; on Nasdaq, a 1.26-to-1 ratio favored advancers.

The S&P healthcare index jumped by 4.45 percent to close at a record high, and the information technology sector also gained strongly, as a divided Congress means slimmer chances for heightened antitrust scrutiny, capital gains taxes and a restoration of parts of the Affordable Care Act. The healthcare index notched its biggest daily percentage gain in about seven months.

Still, investors said they favor a definitive, swift resolution of the presidential race that would clear the way for a deal on a stimulus package to revive the economy.

Despite the rally in stocks, the potential for political uncertainty also sent investors to U.S. Treasuries, sparking the biggest one-day drop in 10- and 30-year bond yields since June. Shares of U.S. banks, which typically track Treasury yields, slumped.

The S&P 500 posted 49 new 52-week highs and no new lows; the Nasdaq Composite recorded 112 new highs and 28 new lows.

Volume on U.S. exchanges was 10.39 billion shares, compared with the 9.09 billion average for the full session over the last 20 trading days.

(With input from Reuters)